Jeff Buchbinder | Chief Equity Strategist

The 2024 election is right around the corner. The recent victories of Former President Donald Trump at the Iowa and New Hampshire primaries have moved Election Day closer, as it seems that the two candidates have been chosen earlier than usual, setting the stage for a contentious rematch of the 2020 race.

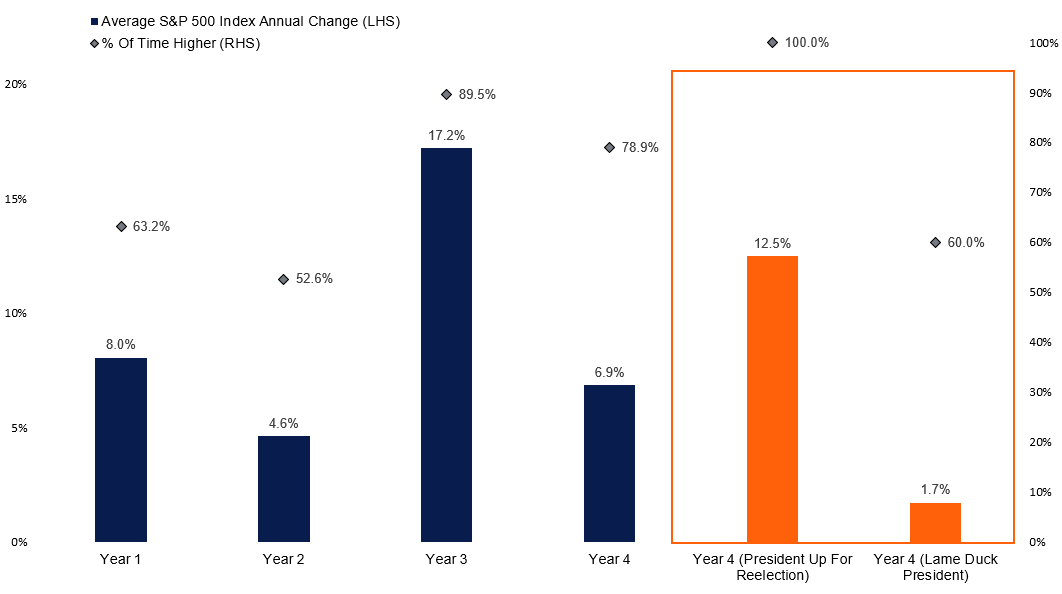

But this time, Joe Biden will be the incumbent. What could that mean for the stock market this year? Diving into the data, first, we find the S&P 500 performs well during election years. Since 1948, the S&P 500 has finished election years with an average return of 6.9%. Next, note that during election years when an incumbent is running for re-election, stocks have been higher each time since 1950 (10 out of 10 times), gaining an average of 12.5%. This is a small sample size for sure, but noteworthy still. Also consider that the last time a presidential candidate ran for re-election was in 2020, when the S&P 500 rose 16.3%.

Presidential Re-Election Campaigns Tend to Be Good for Stocks

Source: LPL Research, FactSet 01/29/24 (Data back to 1948)

Disclosures: All indexes are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results.

The modern design of the S&P 500 stock index was first launched in 1957. Performance back to 1950 incorporates the performance of predecessor index, the S&P 90.

Diving even deeper, we can break out how both Republicans and Democrats fare. This brings on another favorable historic trend for the S&P 500, as Democratic incumbents have a higher average return during election years than their Republican counterparts. Outside of the 2008 financial crisis, however, returns between the two parties are very similar. In other words, the stock market might be more likely to respond to the economic cycle than party politics. In general, that is the way these go, which means do not let politics disrupt your long-term investment plan. Corporate America is resilient and can grow profits and pay dividends in just about any political environment.

Historical trends do help make the case for stocks to enjoy a promising 2024. But, of course, past performance is no guarantee of future results. Still, the fact that these performance trends have been consistent tailwinds for stocks over time is notable, through periods of high inflation, rising interest rates, and recessions.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors. To determine which investment(s) may be appropriate for you, please consult your financial professional prior to investing.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk.

Indexes are unmanaged and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

This material was prepared by LPL Financial, LLC. All information is believed to be from reliable sources; however LPL Financial makes no representation as to its completeness or accuracy.

Unless otherwise stated LPL Financial and the third party persons and firms mentioned are not affiliates of each other and make no representation with respect to each other. Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services.

Asset Class Disclosures –

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

Bonds are subject to market and interest rate risk if sold prior to maturity.

Municipal bonds are subject and market and interest rate risk and potentially capital gains tax if sold prior to maturity. Interest income may be subject to the alternative minimum tax. Municipal bonds are federally tax-free but other state and local taxes may apply.

Preferred stock dividends are paid at the discretion of the issuing company. Preferred stocks are subject to interest rate and credit risk. They may be subject to a call features.

Alternative investments may not be suitable for all investors and involve special risks such as leveraging the investment, potential adverse market forces, regulatory changes and potentially illiquidity. The strategies employed in the management of alternative investments may accelerate the velocity of potential losses.

Mortgage backed securities are subject to credit, default, prepayment, extension, market and interest rate risk.

High yield/junk bonds (grade BB or below) are below investment grade securities, and are subject to higher interest rate, credit, and liquidity risks than those graded BBB and above. They generally should be part of a diversified portfolio for sophisticated investors.

Precious metal investing involves greater fluctuation and potential for losses.

The fast price swings of commodities will result in significant volatility in an investor’s holdings.

Securities and advisory services offered through LPL Financial, a registered investment advisor and broker-dealer. Member FINRA/SIPC.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Deposits or Obligations | Not Bank/Credit Union Guaranteed | May Lose Value