Key Takeaways

- Semiconductors continue to lead the broader market to new highs.

- The growing integration and excitement around artificial intelligence (AI) has revitalized demand and optimism for the industry.

- World chip sales have returned to growth for the first time in roughly 18 months, while the largest chip manufacturer recently forecasted “healthy growth” for 2024.

- Historically, the return of growth in chip cycles has led to continued upside momentum in both semiconductor stocks and the broader U.S. equity market.

Records have been on repeat for the semiconductor space as the outlook for chip demand continues to improve. The proliferation of spending on AI, coupled with an expected rebound in PC demand and increased chip usage across the automotive industry, have helped offset concerns related to elevated inventories and slowing global growth.

As highlighted in the chart below, the Philadelphia Semiconductor Index (SOX) has rallied to new highs after recently breaking out from a bullish cup-with-handle formation. Momentum indicators, breadth, and volume are further confirming the bullish price action. In terms of upside, a minimum technical-based price objective for the SOX sets up near 5,200 based on the size of the prior formation. Perhaps more importantly, and as illustrated in the bottom panel, semiconductors are also leading this bull market, as the SOX vs. S&P 500 (SPX) ratio chart also broke out to new highs.

Semiconductors Breaking Out on an Absolute and Relative Basis

Source: LPL Research, Bloomberg 01/24/24

Disclosures: Past performance is no guarantee of future results. All indexes are unmanaged and can’t be invested in directly.

Taiwan Semiconductor Manufacturing (TSM) — the world’s largest chip manufacturer and a key supplier to both Apple and NVIDIA — further revived confidence in the space after issuing positive revenue guidance during their fourth-quarter earnings release last week. TSM’s Chief Executive Officer C.C. Wei pointed to low to mid-20% revenue gains (in dollar terms) for 2024 and noted, “Our business has bottomed out on a year-over-year basis, and we expect 2024 to be a healthy growth year.”

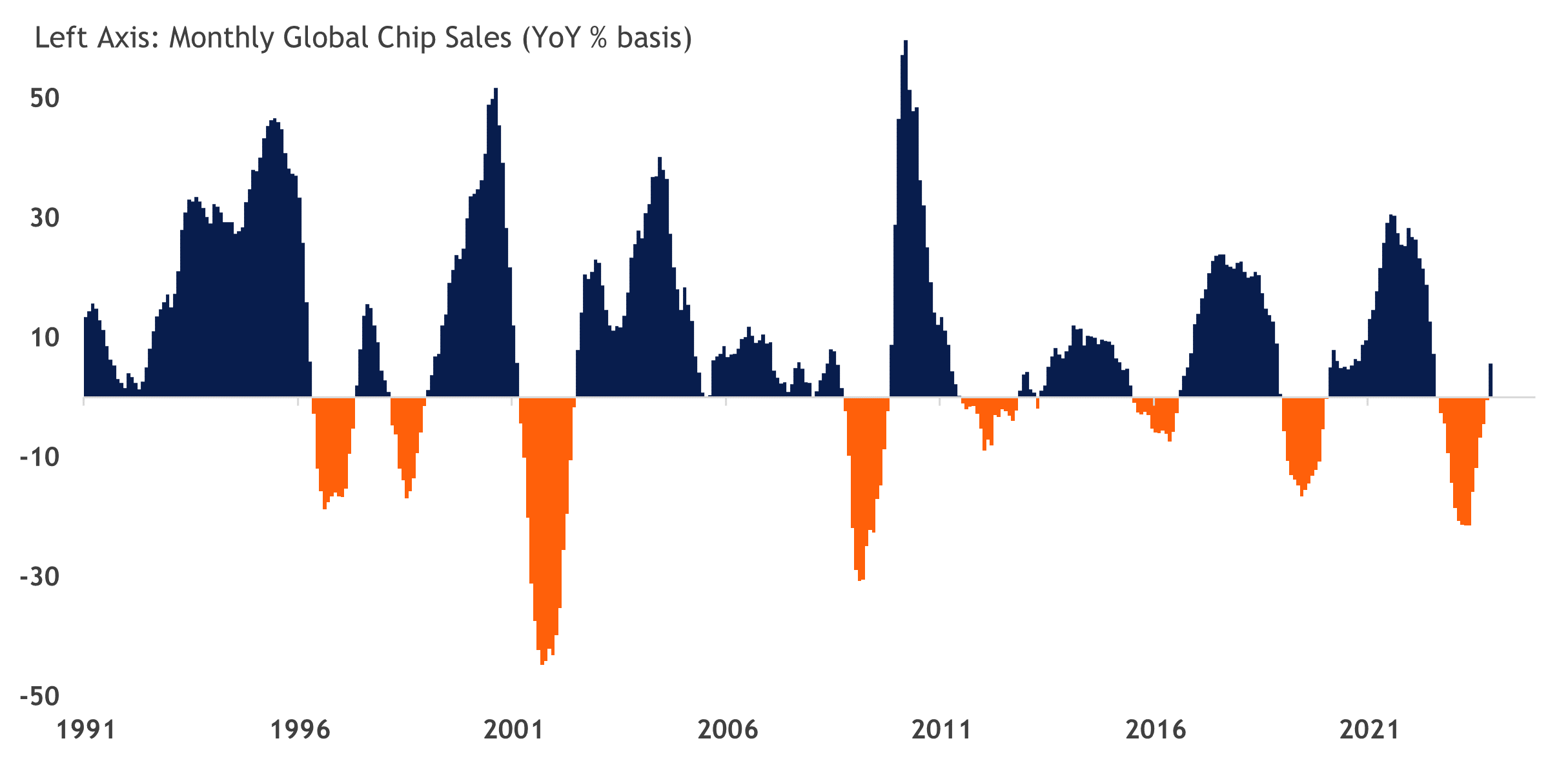

The latest data from the Semiconductor Industry Association (SIA) corroborates TSM’s outlook. As illustrated in the table below, worldwide chip sales increased on a year-over-year basis in November for the first time since the summer of 2022.

Global Chip Sales Turn Positive

Source: LPL Research, SIA, 01/24/24

Disclosure: Past performance is no guarantee of future results.

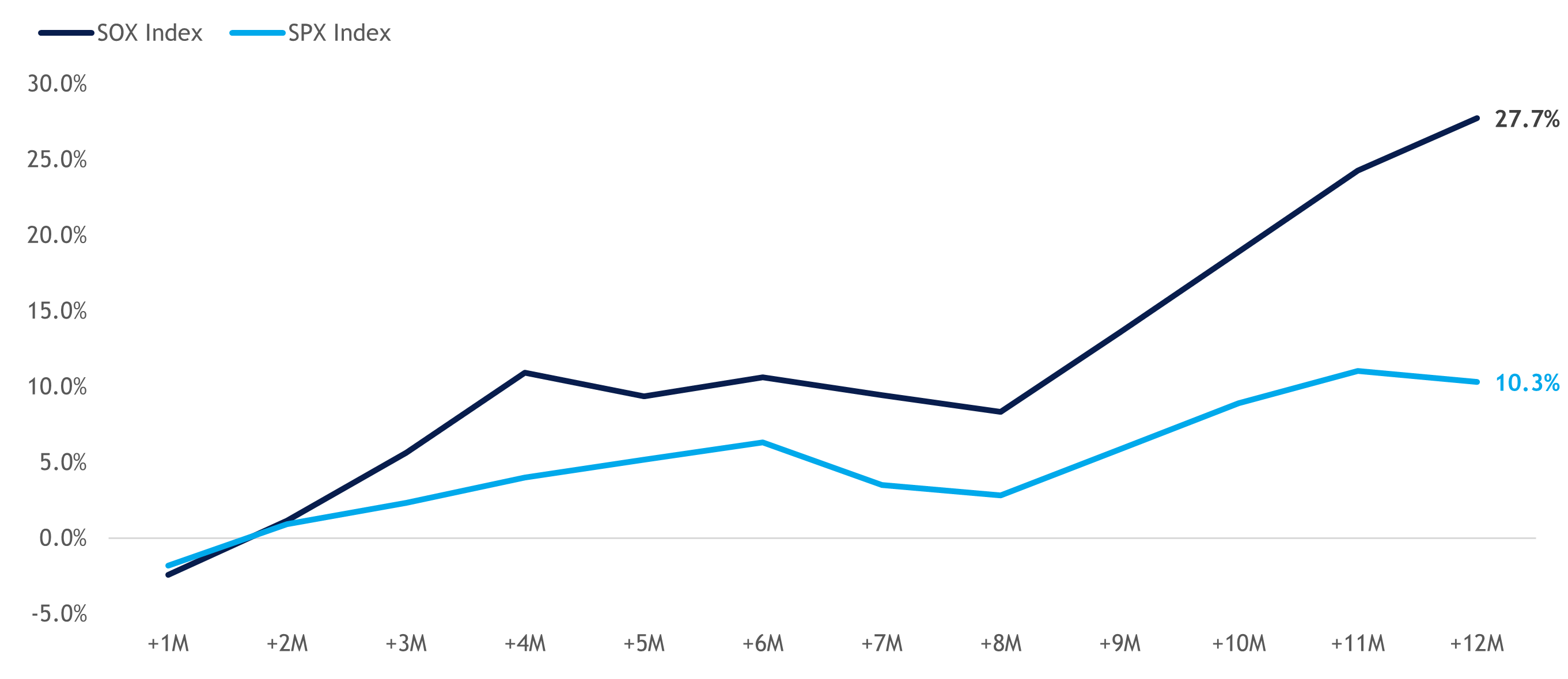

Given the cyclicality of the global semiconductor market, we analyzed how the SOX performs after each cycle turns positive. Considering semiconductors are also widely regarded as a leading economic indicator given their vast application use across industries, we also included how the broader SPX performed during these positive chip cycle shifts. As highlighted in the table below, momentum in both indexes continued. The SOX outperformed with an average 12-month forward return of 27.7% (eight of the nine periods also posted positive returns during the 12-month period).

Semis Lead, Stocks Follow

Average SOX and SPX Return After Semi Sales Turn Positive

Source: LPL Research, Bloomberg 01/24/24

Disclosures: Past performance is no guarantee of future results. All indexes are unmanaged and can’t be invested in directly.

Summary

An upcycle for semiconductors appears to be underway as the excitement for AI revives demand. The growth story, supported by bullish guidance from the world’s largest chip manufacturer, the recent return to global chip revenue growth, recovering PC sales, and rising demand from the automotive industry, have all helped offset concerns over rich valuations and prior supply gluts. Historically, the start of growth cycles in chips has led to continued momentum for semiconductor stocks and a bullish sign for the broader market.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors. To determine which investment(s) may be appropriate for you, please consult your financial professional prior to investing.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk.

Indexes are unmanaged and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

This material was prepared by LPL Financial, LLC. All information is believed to be from reliable sources; however LPL Financial makes no representation as to its completeness or accuracy.

Unless otherwise stated LPL Financial and the third party persons and firms mentioned are not affiliates of each other and make no representation with respect to each other. Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services.

Asset Class Disclosures –

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

Bonds are subject to market and interest rate risk if sold prior to maturity.

Municipal bonds are subject and market and interest rate risk and potentially capital gains tax if sold prior to maturity. Interest income may be subject to the alternative minimum tax. Municipal bonds are federally tax-free but other state and local taxes may apply.

Preferred stock dividends are paid at the discretion of the issuing company. Preferred stocks are subject to interest rate and credit risk. They may be subject to a call features.

Alternative investments may not be suitable for all investors and involve special risks such as leveraging the investment, potential adverse market forces, regulatory changes and potentially illiquidity. The strategies employed in the management of alternative investments may accelerate the velocity of potential losses.

Mortgage backed securities are subject to credit, default, prepayment, extension, market and interest rate risk.

High yield/junk bonds (grade BB or below) are below investment grade securities, and are subject to higher interest rate, credit, and liquidity risks than those graded BBB and above. They generally should be part of a diversified portfolio for sophisticated investors.

Precious metal investing involves greater fluctuation and potential for losses.

The fast price swings of commodities will result in significant volatility in an investor’s holdings.

Securities and advisory services offered through LPL Financial, a registered investment advisor and broker-dealer. Member FINRA/SIPC.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Deposits or Obligations | Not Bank/Credit Union Guaranteed | May Lose Value