Dr. Jeffrey Roach | Chief Economist

Market pundits often shy away from the admission that “this time is different.” But why should we be afraid of that? Markets and the economy are still adjusting to an era of higher rates, a remote labor force, and a global economy filled with political uncertainty. There are a few things that are different, and it’s important to remember investors can find opportunities amid the flux.

This LPL Research blog will share a few charts, but for more, check out the Econ Market Minute about the diverging paths among retailers.

E-commerce is Gaining Greater Wallet Share

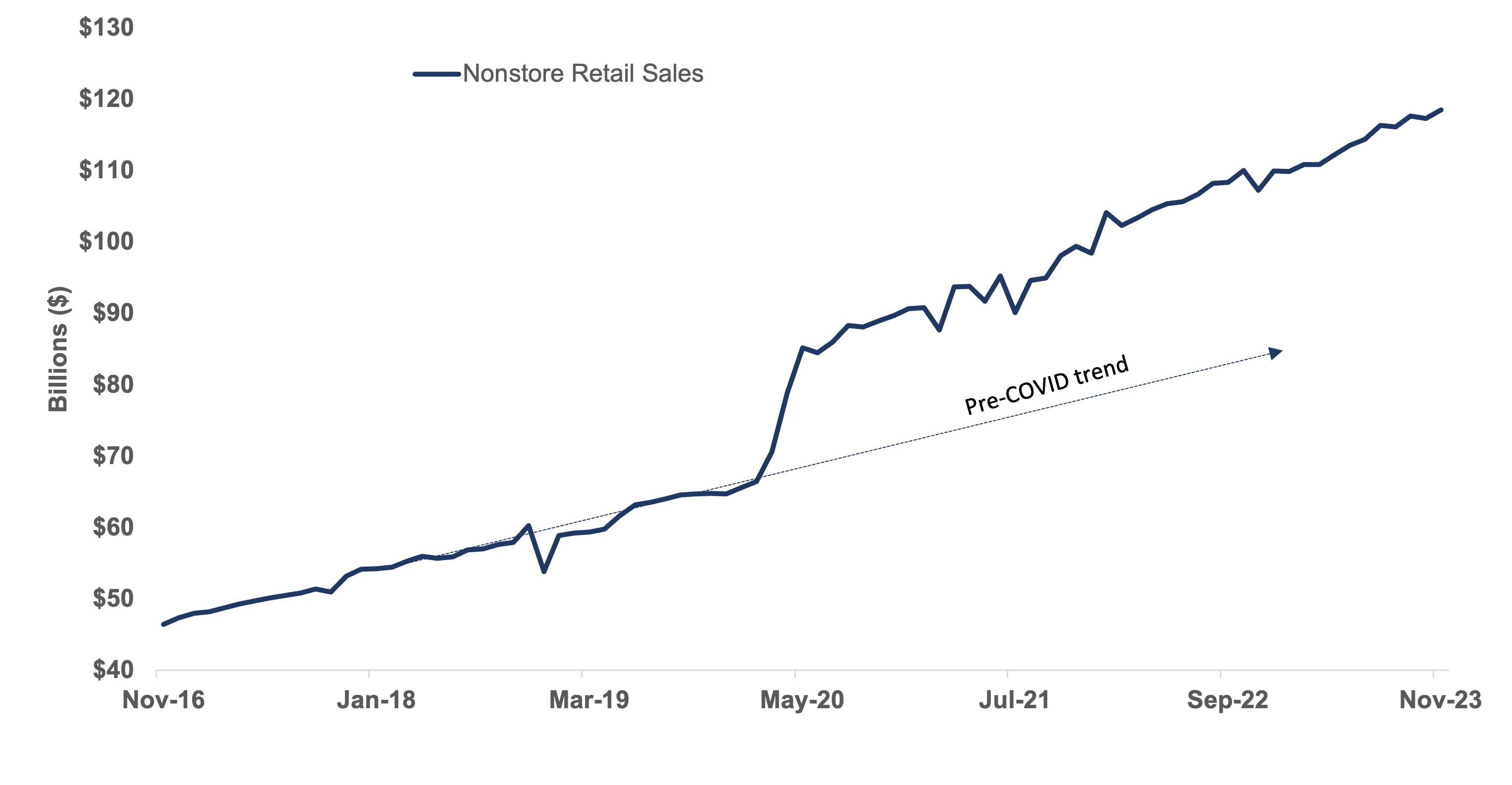

One thing different right now is post-pandemic shopping behavior. As noted in the chart below, the pandemic accelerated the use of e-commerce. Consumers shifted to online shopping, and so far, that habit seems to have stuck. Consumers are shunning department stores, instead choosing to shop online and hunt for bargains and prefer the convenience of e-commerce. This shift has ramifications for retailers working to gain wallet share.

Business Shutdowns Accelerated the Use of E-commerce — the Shift to Online Sales is Sticking

Source: LPL Research, U.S. Census Bureau 12/15/23

Disclosures: Past performance is no guarantee of future results.

GDP Overstates Growth

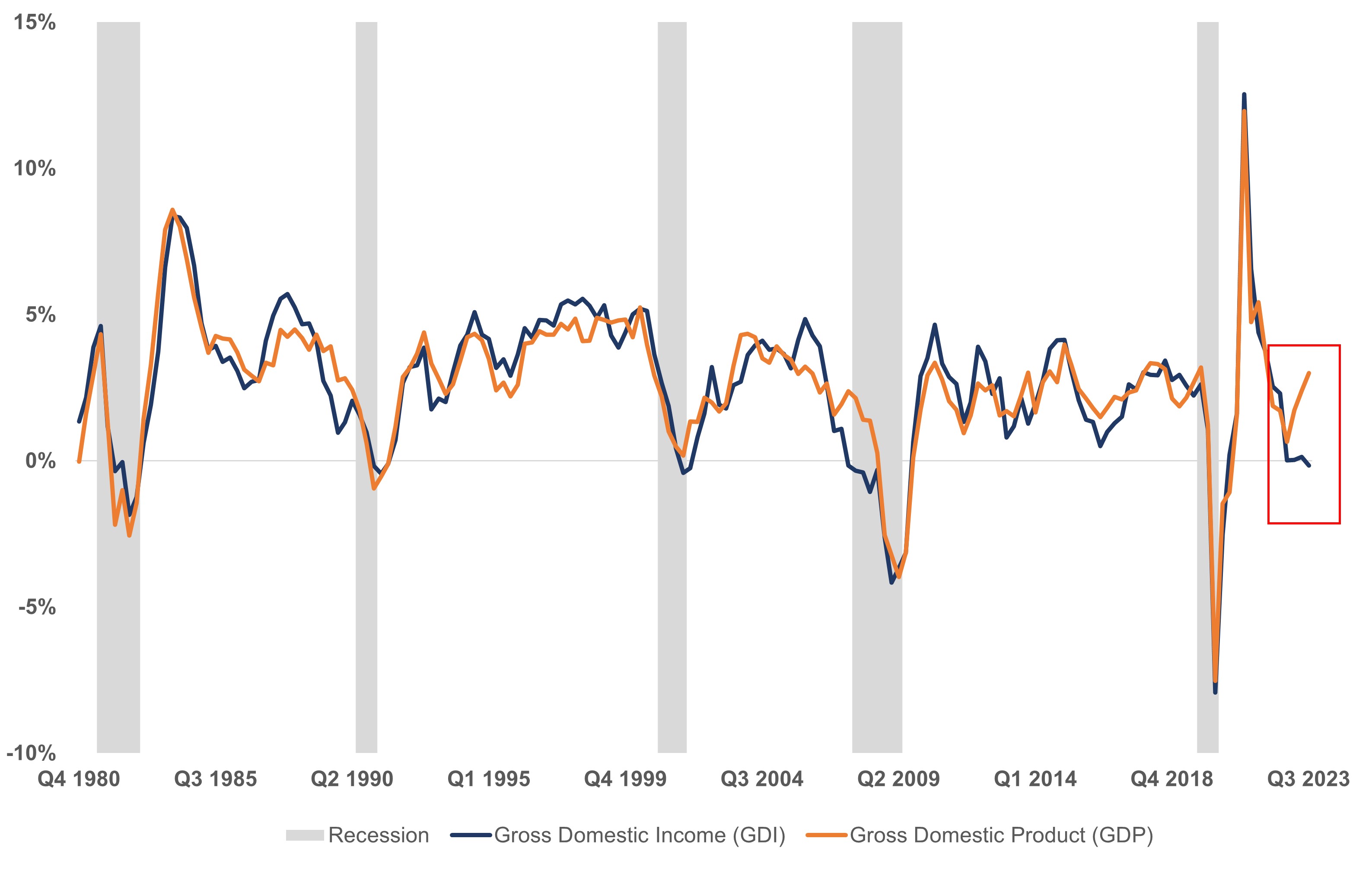

Another part of the economy that’s different this time around is Gross Domestic Income (GDI). The last time we had such a gap between these GDI and Gross Domestic Product (GDP) measures was 2007, when the economy was about to experience a recession. GDP and GDI are corresponding measures of the economy but should match. GDP is all the spending by businesses, consumers, and the government, whereas GDI is the aggregate wages, salaries, corporate profits, and other incomes generated by economic activity.

The Economy is Not as Strong as it Seems — as GDI Indicates

Source: LPL Research, U.S. Bureau of Economic Analysis 12/20/23

Disclosures: Past performance is no guarantee of future results.

As investors set expectations for the new year, it’s important to take note of the opportunities available.

A Catalyst for Homebuilders

I mentioned a relatively large percentage of remote workers. This new regime has ramifications for the housing market. Typically, investors would think the residential real estate market is one of the most interest rate sensitive areas of the economy. But when households are less constrained by the job market, when homebuilders can buy down rates for prospective buyers, and when inventories of existing homes are at near-cycle lows, investors will likely witness a catalyst for homebuilders.

The low inventory of existing homes for sale was a catalyst for homebuilders in recent months. Housing starts in November were much higher than in 2019 as homebuilders got creative with buying down mortgage rates for buyers. We are noticing strength in both single-family and multi-family activity as homebuilders take advantage of the low supply of existing homes on the market. Most of the housing starts were in the South as hybrid work continues to be a boon for households seeking a lower cost of living. Investors have clearly rewarded homebuilders, as low inventory of existing homes on the market has created an opportunity for new construction. Falling mortgage rates also helped ignite demand.

Summary

Investors should expect to find opportunities despite the uncertainty about the upcoming year. Political tensions remain elevated around the globe, consumers still have rising debt burdens, and governments are saddled with debt. Yet, opportunities remain, and savvy investors will find them.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors. To determine which investment(s) may be appropriate for you, please consult your financial professional prior to investing.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk.

Indexes are unmanaged and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

This material was prepared by LPL Financial, LLC. All information is believed to be from reliable sources; however LPL Financial makes no representation as to its completeness or accuracy.

Unless otherwise stated LPL Financial and the third party persons and firms mentioned are not affiliates of each other and make no representation with respect to each other. Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services.

Asset Class Disclosures –

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

Bonds are subject to market and interest rate risk if sold prior to maturity.

Municipal bonds are subject and market and interest rate risk and potentially capital gains tax if sold prior to maturity. Interest income may be subject to the alternative minimum tax. Municipal bonds are federally tax-free but other state and local taxes may apply.

Preferred stock dividends are paid at the discretion of the issuing company. Preferred stocks are subject to interest rate and credit risk. They may be subject to a call features.

Alternative investments may not be suitable for all investors and involve special risks such as leveraging the investment, potential adverse market forces, regulatory changes and potentially illiquidity. The strategies employed in the management of alternative investments may accelerate the velocity of potential losses.

Mortgage backed securities are subject to credit, default, prepayment, extension, market and interest rate risk.

High yield/junk bonds (grade BB or below) are below investment grade securities, and are subject to higher interest rate, credit, and liquidity risks than those graded BBB and above. They generally should be part of a diversified portfolio for sophisticated investors.

Precious metal investing involves greater fluctuation and potential for losses.

The fast price swings of commodities will result in significant volatility in an investor’s holdings.

Securities and advisory services offered through LPL Financial, a registered investment advisor and broker-dealer. Member FINRA/SIPC.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Deposits or Obligations | Not Bank/Credit Union Guaranteed | May Lose Value

For Public Use – Tracking: 519258